Such an approach allows the company to evenly spread the costs over the whole period of use. Under the double-declining balance method, the book value of the trailer after three years would be $51,200 and the gain on a sale at $80,000 would be $28,800, recorded on the income statement—a large one-time boost. Under this accelerated method, there would have been higher expenses for those three years and, as a result, less net income.

How Does Depreciation Impact the Financial Statements?

A depreciation expense, on the other hand, is the portion of the cost of a fixed asset that was depreciated during a certain period, such as a year. Depreciation expense is recognized on the income statement as a non-cash expense that reduces the company’s net income or profit. For accounting purposes, the depreciation expense is debited, while the accumulated depreciation is credited. The declining balance method is a type of accelerated depreciation used to write off depreciation costs earlier in an asset’s life and to minimize tax exposure.

- But in the absence of such data, the number of assumptions required based on approximations rather than internal company information makes the method ultimately less credible.

- Most companies use a single depreciation methodology for all of their assets.

- Assumptions in depreciation can impact the value of long-term assets and this can affect short-term earnings results.

- Conceptually, the depreciation expense in accounting refers to the gradual reduction in the recorded value of a fixed asset on the balance sheet from “wear and tear” with time.

- Writing off only a portion of the cost each year, rather than all at once, also allows businesses to report higher net income in the year of purchase than they would otherwise.

- The costs of these intangible assets can be deducted over their useful life via amortization or depreciation.

Sum-of-the-Years’ Digits Depreciation

Accumulated depreciation is a contra-asset account on a balance sheet; its natural balance is a credit that reduces the overall value of a company’s assets. Accumulated depreciation on any given asset is its cumulative depreciation up to a single point in its life. Depreciation is an accounting practice used to spread the cost of a tangible or physical asset, such as a piece of machinery or a fleet of cars, over its useful life.

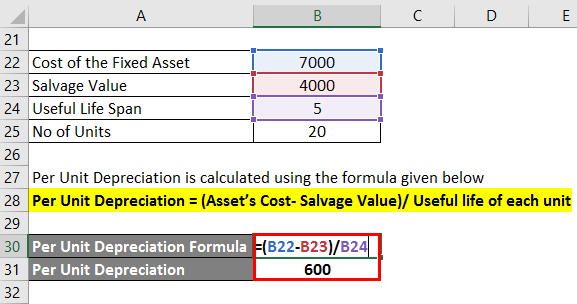

Units of production depreciation

The straight-line method is calculated by subtracting the salvage value from the asset’s purchase price and then dividing the resulting figure by the projected useful life of the asset. This method calculates the depreciation cost by subtracting the salvage value from the initial purchase price and any additional costs. Depreciated cost is the value of a fixed asset minus all of the accumulated depreciation that has been recorded against it. In a broader economic sense, the depreciated cost is the aggregate amount of capital that is « used up » in a given period, such as a fiscal year. The depreciated cost can be examined for trends in a company’s capital spending and how aggressive their accounting methods are, seen through how accurately they calculate depreciation.

Artificial Intelligence And Machine Learning In Depreciation

The two main assumptions built into the depreciation amount are the expected useful life and the salvage value. Salvage value can be based on past history of similar assets, a professional appraisal, or a percentage estimate of the value of the asset at the end of its useful life. Buildings and structures can be depreciated, but land is not eligible for depreciation.

Understanding these fundamental concepts empowers business owners to make informed decisions about calculating and applying depreciation expenses in their financial reporting. This knowledge forms the foundation for exploring various methods of calculating depreciation, each with its own unique advantages and applications. Calculating depreciation expense is a crucial skill for business owners seeking to accurately track asset value over time.

If production declines, this method lowers the depreciation expenses from one year to the next. The depreciated cost is the value of an asset after its useful life is complete, reduced over time through depreciation. The depreciated cost method always allows for accounting records to show an asset at its current value as the value of the asset is constantly reduced by calculating the depreciation cost.

While the calculations might be more complex, the benefits of accurate asset valuation and expense recognition far outweigh the additional effort required. Remember, precision in financial reporting is key to making informed business decisions and maintaining compliance with accounting standards. For business owners managing equipment or machinery with variable usage, this method can provide valuable insights into asset utilization and help inform decisions about maintenance, replacement, and capacity planning. Remember, the key to success with this method lies in accurate tracking and realistic estimations of total lifetime production. Depreciation is a non-cash expense that allocates the purchase of fixed assets, or capital expenditures (Capex), over its estimated useful life.

If a manufacturing company were to purchase $100k of PP&E with a useful life estimation of 5 years, then the depreciation expense would be $20k each year under straight-line depreciation. cash flow statement: what it is and examples A straight-line basis assumes that an asset’s value declines at a steady and unchanging rate. If this isn’t the case, which it sometimes won’t be, a different method should be used.